State of the Industry Report: 2025 Salary Survey

An industry in motion: Inside the pay, experience, and outlook of Canada’s sign professionals

Each year, Sign Media Canada surveys professionals across the country to uncover how the sign industry is changing—who’s working where, what they earn, and how they feel about the future. The 2025 results, based entirely on hundreds of anonymous answers by professionals across the country, paint a picture of an experienced, loyal, and largely satisfied workforce navigating steady technological and business shifts.

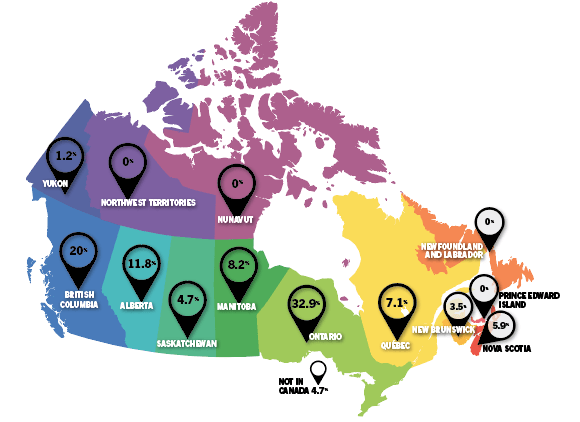

Region

Which provinces lead the sign industry today?

Regional distribution highlights where the sign industry is most active. Ontario continues to lead as the national hub, while strong showings in British Columbia and Alberta reflect a broad, coast-to-coast presence. Smaller provinces maintain pockets of production and craft-focused businesses that keep local markets thriving.

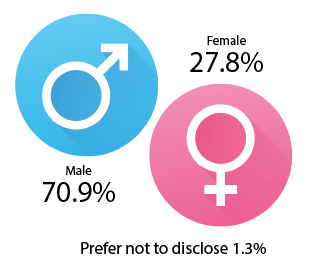

Gender

Who’s represented in the workforce?

Gender balance remains an ongoing challenge. The sign industry still attracts more men overall, but more women are entering business ownership, management, and design-focused roles across the country.

Age

How experienced is the average sign professional?

The survey results underscore the maturity of the Canadian sign industry. With most respondents over 50, the data reflects a seasoned workforce shaped by decades of trade experience and technological adaptation. This also signals a potential generational transition in the years ahead.

Under 24 0.0%

25 to 29 3.8%

30 to 34 0.0%

35 to 39 1.3%

40 to 44 10.1%

45 to 49 11.4%

50 to 54 12.7%

55 to 59 24.1%

Over 60 36.6%

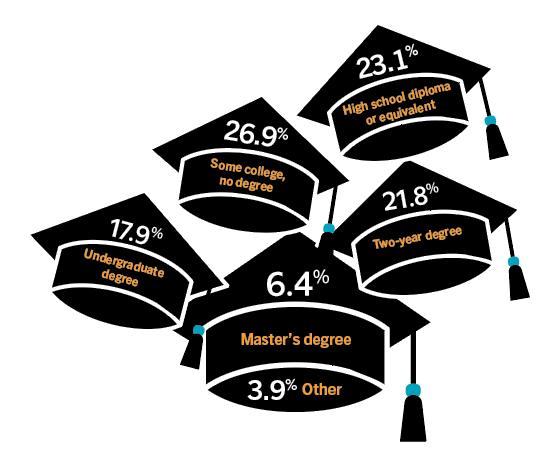

Education

How much formal education do sign professionals have?

Formal education varies widely, but hands-on experience remains the foundation of most careers in signage. While some professionals hold college or university degrees, many entered the industry through apprenticeships, trade programs, or direct, practical training rather than academic paths.

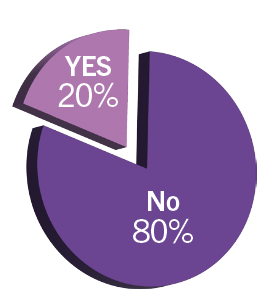

Is your degree related to the sign industry?

Few professionals hold degrees specifically tied to signmaking or visual communication. This highlights how the trade often draws people from diverse educational backgrounds who learn core production, design, and business skills through experience rather than formal study.

Professional organizations

How connected is the industry?

Professional associations continue to anchor the industry, connecting businesses for advocacy, training, and networking. SAC remains the most common affiliation, followed by ISA and other specialized groups, showing that many companies value community engagement and professional standards.

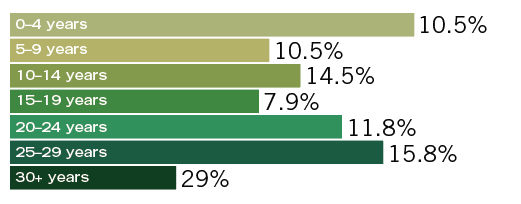

Years in the business

How long have professionals stayed in the industry?

Longevity is a defining trait of this sector. Nearly a third of professionals have been working in signage for more than three years, reflecting deep expertise and loyalty within a relatively small, relationship-driven community.

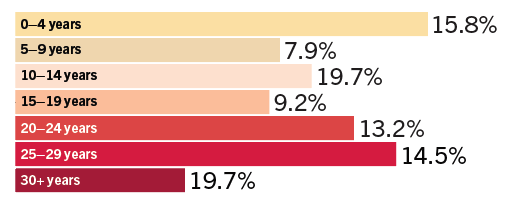

Years with current company

Do sign professionals tend to stay put?

The data shows stability, with many professionals remaining with the same employer—or running their own company—for decades. This consistency speaks to the close-knit, often family-based nature of many Canadian sign businesses.

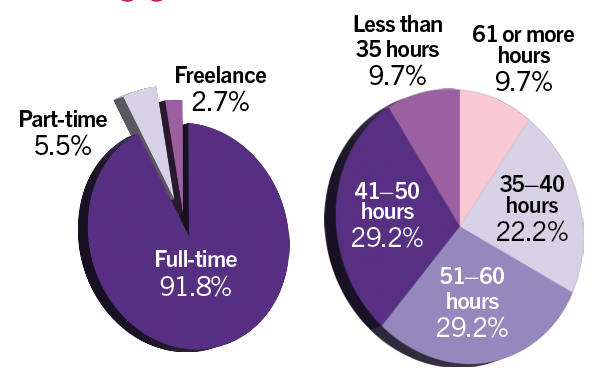

Employment status and hours

How much time do sign professionals spend on the job?

Almost all respondents are full-time workers, and many report working well beyond standard hours. The results reflect the demanding schedules of this kind of work, regardless of the position one holds in the company.

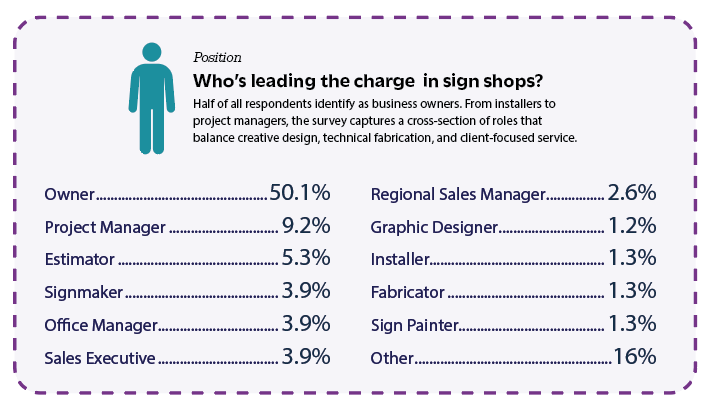

Supervision and pay

Who’s managing teams—and how are they compensated?

Leadership among respondents is common—nearly three-quarters (72.2 per cent) of professionals supervise other employees. However, only a minority are paid hourly (29.2 per cent), suggesting many hold management or ownership roles with salaried or profit-based compensation structures.

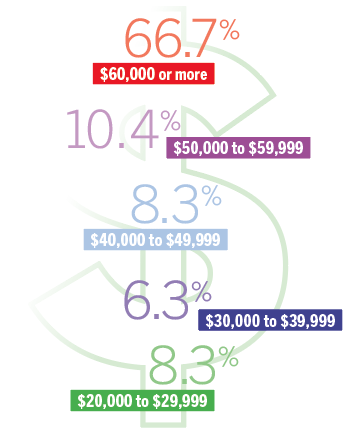

Salary

How much are sign professionals earning in 2025?

Earnings remain strong, with two-thirds of professionals reporting annual salaries of $60,000 or higher. Compensation levels vary by business size, role, and region but generally reflect the industry’s skilled and specialized nature.

The future

Where do professionals see themselves in five years?

Many professionals expect to maintain their current positions or retire within the next five years. This finding reinforces the aging profile of the workforce and the ongoing need for new entrants to sustain the trade.

Raises

How much did respondents’ salaries increase most recently?

Recent raises appear sporadic, ranging from none to roughly 10 per cent, with some owners going years without adjustments.

Key takeaways:

- Many have not given themselves raises in years, prioritizing reinvestment and business growth.

- Workload and responsibilities have increased, including management and multi-skilled roles.

- Some companies report growth, stabilization, and transition from small owner-operated operations.

- Challenges include labour shortages, market fluctuations, and competition from low-cost providers.

- Respondents generally report high job satisfaction, strong teams, and pride in company accomplishments.

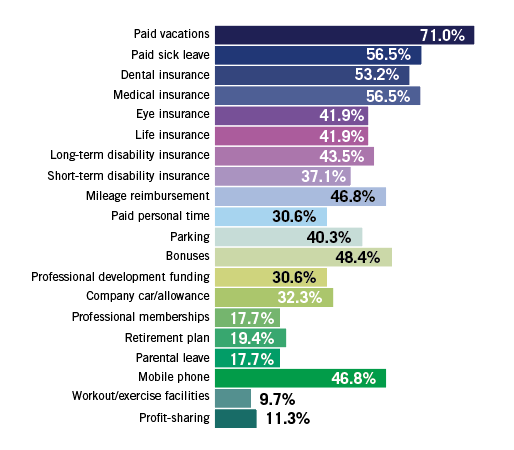

Benefits

What perks come with the paycheck?

The majority of professionals enjoy paid vacations and health coverage, but benefits such as profit-sharing, retirement plans, and wellness programs remain less common. This reflects both the small-business composition of the industry and evolving priorities around employee well-being.

Pain points

Respondents respondents have reported certain job frustrations that highlight critical issues needing attention. Addressing these concerns is essential for improving overall job satisfaction and organizational performance.

They include:

- Difficulty finding and retaining qualified employees, especially installers and entry-level staff.

- Clients delaying or refusing payment, and demanding faster service at lower prices.

- Competition undercutting prices, often ignoring quality or compliance.

- Time pressures, last-minute requests, and heavy administrative workload.

- Balancing wages, profitability, and cash flow challenges.

The reasons for these pain points are:

- Managing diverse personalities and keeping employees motivated is time-consuming.

- Clients and competitors pressure businesses to lower standards and prices.

- Small companies struggle with multitasking, juggling large jobs, admin, and client demands.

- Customer entitlement, unrealistic expectations, and online/instant gratification culture create stress.

- Limited margins make it hard to reward staff or maintain quality consistently.

- Industry complexity, regulatory issues, and favouritism add ongoing challenges.

Job satisfaction

Are sign professionals happy in their work?

Overall job satisfaction remains stable or improved for most professionals. The data suggests resilience despite industry challenges such as economic pressure and technological change, with a majority feeling as or more fulfilled than five years ago.

More satisfied: 33.3%

Just as satisfied: 39.4%

Less satisfied: 27.3%

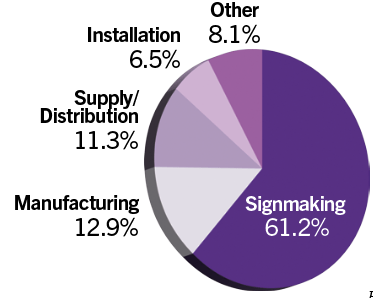

Nature of business

What kinds of work define the industry?

Signmaking remains the core activity for most companies, though manufacturing, supply, and installation play crucial roles. This diversity highlights the interconnected ecosystem that drives the Canadian sign and graphics industry.

Business scale

How much revenue does your business generate?

The responses reflect a broad range of company sizes within the sign industry, spanning from small owner-operated shops to multi-million-dollar operations. The distribution shows the diversity of businesses contributing to the sector.

Do you use artificial intelligence (AI) in your operations?

According to the respondents, here are the broad ways in which AI is being used:

- Some are actively using AI for design, content creation, copywriting, SOPs, emails, quoting, financial/legal research, and brainstorming.

- Others are just starting to explore it or use it to assist them in some tasks.

- Many don’t use AI due to lack of understanding, time, system compatibility, or skepticism about its usefulness.

- A few see AI as helpful for inspiration but not as a final solution.

Company size

How big are most Canadian sign shops?

Small businesses continue to define the sector, with more than three-quarters employing 10 or fewer people. These operations often rely on local relationships and specialized skills to compete with larger firms.

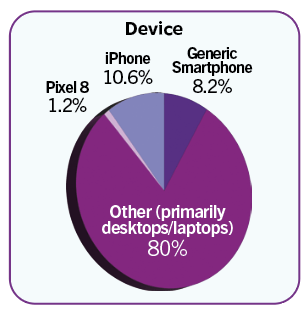

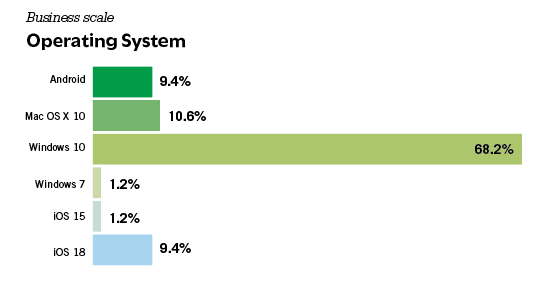

User technology profile

This data illustrates how respondents accessed the survey, providing insight into the devices, browsers, and operating systems most commonly used across the sign industry. The results suggest most participants completed the survey on desktop computers running Windows, using modern versions of Google Chrome. Mobile participation, while present, remained limited.

The 2025 salary survey highlights a stable, experienced, and deeply invested industry that continues to value craftsmanship and community. While wages remain healthy and satisfaction steady, the data also points to an aging workforce and a need for greater focus on succession, recruitment, and evolving benefits to attract the next generation of sign professionals.